Why Do It? The Strategic Calculus of Values-Based Branding

Lessons from Bud Light and Nike on Brand Strategy in the Age of Polarization

Amazon, Bud Light, Disney, Goya, PepsiCo, Starbucks, Walmart, Tesla, and Cracker Barrel – the list of companies that have experienced controversies over their brands’ social or political stands or associations is growing.

In this post, we revisit the well-known stories of two brands – Bud Light and Nike – to examine why companies wade into polarized territory, what drives those decisions, and what the consequences reveal about doing business in an era of values-based consumption. Our argument is that political controversies are not accidents; they result from commercial necessities. As ever, reality is more complicated than most Monday-morning quarterback-pundits would make you believe.

The Erosion of Mass-Market Dominance

For consumer brands, opportunities to reach consumers have never been greater – yet it has never been harder to cut through, stand out, and sustain relevance. A proliferation of brands now serves niches and subsegments that were once unimaginable. In 2024, U.S. trademark applications for new brands hit record highs, particularly in consumer goods, apparel, and wellness. At the same time, ever more brands are competing for consumer attention.

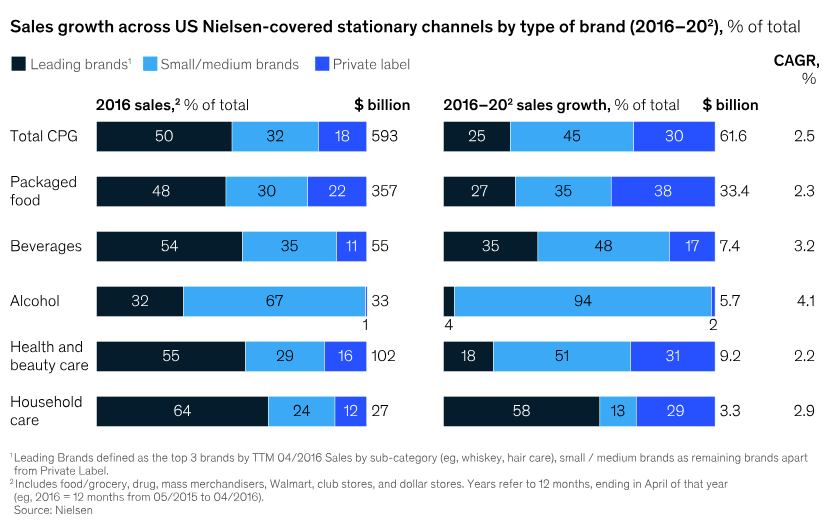

Consumer packaged goods (CPG) – food, beverages, cosmetics, and household supplies – have been at the forefront of this shift. For decades, CPG success rested on two pillars: mass-market brand building and close partnerships with mass channels to secure broad distribution. This model fueled stable growth and gross margins roughly 25 percent higher than those of non-branded competitors.

That model has been upended by the internet. CPG’s durable nature and significant share of consumers’ disposable income have made them prime targets for direct-to-consumer marketing and distribution. Large incumbents have steadily lost market share to nimble upstarts. As a 2022 Marketing Science study notes, “The rapid growth of smaller brands represents a striking, structural break in the historically high and persistent concentration of CPG categories and the dominance of large, national brands.” In their 2025 State of Consumer Products Report, EY concludes that “many big CPG companies are facing a relentless drift towards irrelevance.”

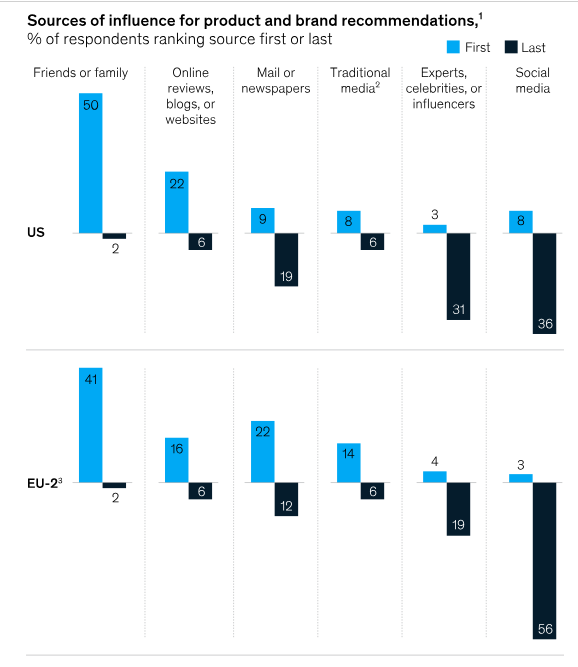

The shift is not only about greater choice. The rise of smaller brands has been driven by consumer preference for deeper alignment with their specific identities, tastes, and values. Consumers – especially younger ones – want brands that share their values and demonstrate social responsibility. Smaller brands with more homogenous customer bases are better positioned to deliver on this desire. And the fact that friends and families are by far the most important influencing factors for purchase decisions means that growing societal polarization directly translates into market dynamics.

The beer revolution

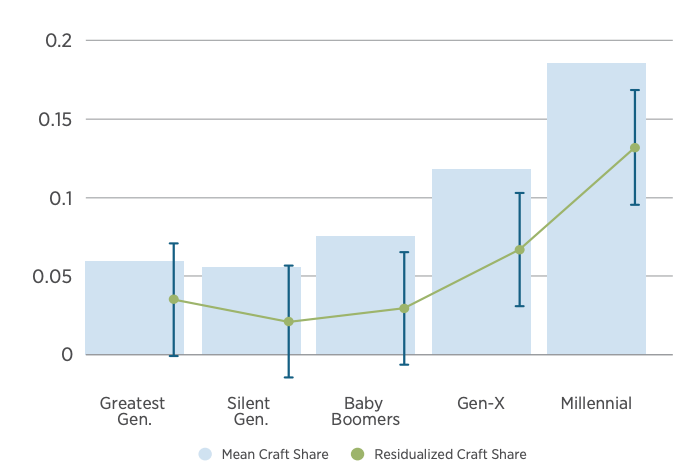

Few sectors have seen the mass-market model disrupted as profoundly as beer. For more than two decades, large domestic brands have steadily ceded ground to craft brewers and imports. Between 2010 and 2019, craft beer sales nearly tripled – from $10 billion to $29.3 billion. Even with modest declines in recent years, craft beer still accounted for roughly 25% of total U.S. retail beer sales in 2024. This transformation has been fueled by younger consumers, who tend to favor smaller, more authentic brands and exhibit weaker traditional brand loyalties.

As Steve Hindy writes in The Craft Beer Revolution: “The internet has arguably been the greatest ally of the craft beer revolution. Today nearly every craft brewer has a website and someone to talk directly to its customers and fans through social media.”

Craft beer brands have often embraced progressive causes – supporting LGBTQ+ rights, racial justice initiatives like the Black is Beautiful collaboration, environmental sustainability, and gender equity in brewing – to signal authenticity and social consciousness. By aligning with these movements and promoting “drink local” and anti-corporate independence, they’ve built strong emotional bonds with younger, urban, and politically liberal consumers who see their beer choices as extensions of their values.

Bud Light: Misjudging the Fault Line

This industry transformation set the stage for the 2023 controversy surrounding Bud Light’s marketing partnership with transgender influencer Dylan Mulvaney. The details are well known: An Instagram post by Mulvaney, thanking the brand for sending a can stating “Cheers to 365 Days of Woman Hood” was enough to ignite the ire of Kid Rock, the conservative base, and President Trump, and to become a lightning rod in the culture wars. Bud Light appeared blindsided by the backlash – first remaining silent, then issuing a vague statement about never intending to offend anyone with AB InBev’s CEO emphasizing on breakfast TV that “it was just one can”. The result was disastrous: conservatives viewed the response as weak, while liberals saw it as a lack of conviction, leaving both sides to abandon the brand.

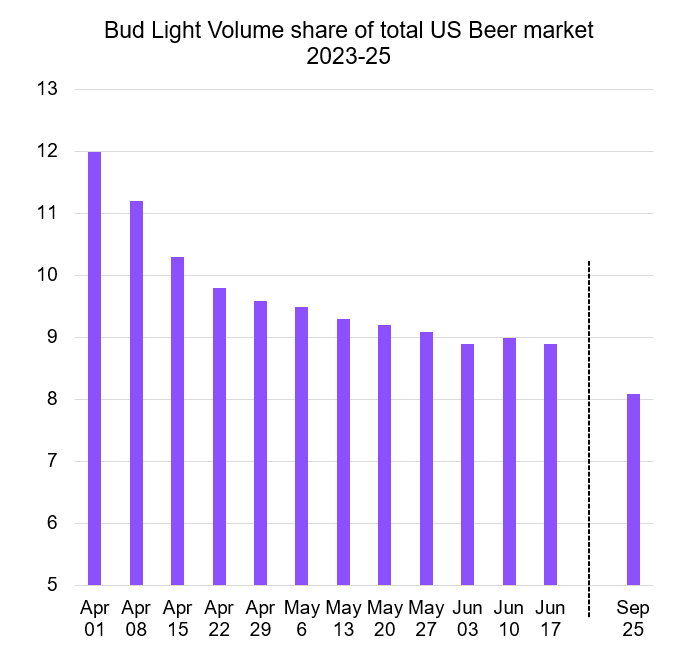

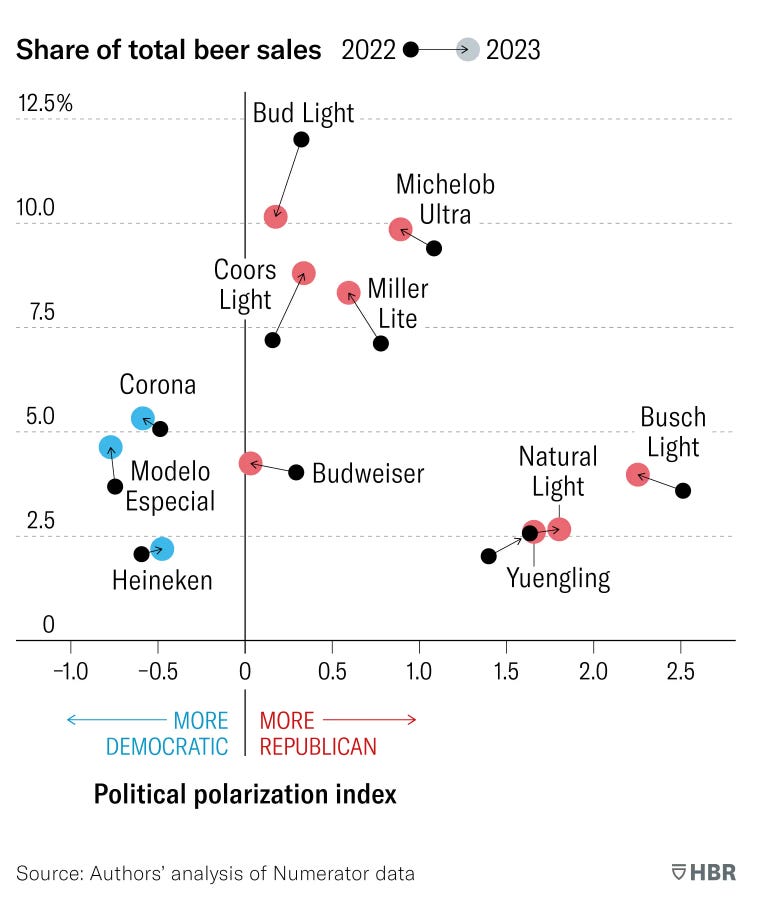

The commercial impact was swift and severe. Within four weeks, sales of Bud Light – the #1 U.S. beer brand since 2001 – fell by 30%, with Coors Light and Miller Lite rapidly capturing its lost market share. The damage extended beyond Bud Light: AB InBev’s broader portfolio saw total sales volumes drop 14%. Two years later, the picture has only worsened. By September 2025, Bud Light’s market share had fallen to just 8.1%.

Why did Bud Light take such a risk? According to then–Vice President of Marketing Alissa Heinerscheid, the campaign was a strategic response to a deeper, long-term problem: “The brand was in decline; it’s been in decline for a really long time. And if we do not attract young drinkers to come and drink this brand, there will be no future for Bud Light.”

Bud Light’s core audience – older, male, and rural – was steadily shrinking. To secure the brand’s future, management aimed to broaden its appeal to younger drinkers and women by adopting a lighter, more inclusive tone. AB InBev endorsed the repositioning, reportedly increasing Bud Light’s marketing budget fivefold. In truth, this was less a radical pivot than an extension of existing efforts: Bud Light had long engaged with the LGBTQ+ community, sponsoring Pride events, releasing a Pride-themed can in 2019, and donating $200,000 to the National LGBT Chamber of Commerce in 2022.

The strategic error: What the brand overlooked were the deep ideological fault lines between its existing and target customer groups. Bud Light’s core consumers leaned heavily Republican, and while many had grown comfortable with brands supporting gay rights, transgender rights activism remains far more divisive among conservative audiences.

This was particularly risky in a category like beer – and light beer especially – where products are highly substitutable. Although consumers display some brand loyalty, it’s rarely based on taste or functional differentiation; blind tests consistently show that most drinkers cannot distinguish between leading brands. Beer is a fast-moving consumer good with minimal switching costs and heavy reliance on brand equity and reputation.

Bud Light correctly recognized that values had become central to the modern consumer value proposition – a dynamic that had fueled the rise of craft beer over the past decade. But it misjudged the depth of the values divide within its own customer base, turning what was intended as a gesture of inclusion into a catalyst for division. In Bud Light’s case, the combination of a sharp ideological split and a highly substitutable product proved especially damaging.

Bud Light’s updated strategy reflects this lesson. The brand has doubled down on its conservative-leaning core audience, announcing a $100 million sponsorship with the Ultimate Fighting Championship. UFC president Dana White publicly emphasized that the partnership was “as much about money as it is about shared values,” underscoring the repositioning’s intent to realign the brand culturally as well as commercially.

Nike: Strategic Alignment

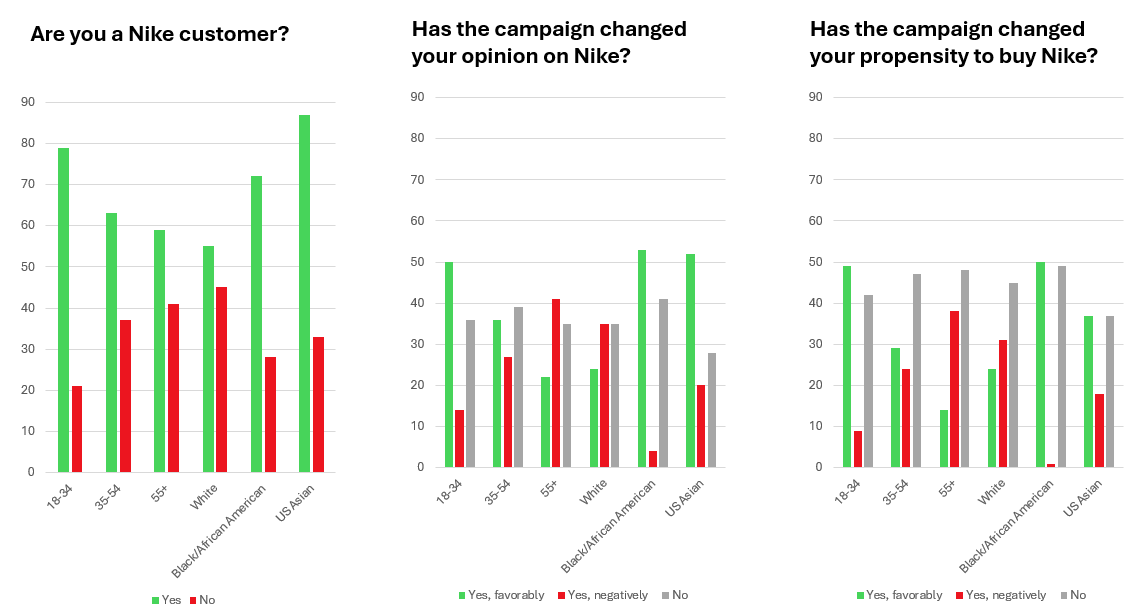

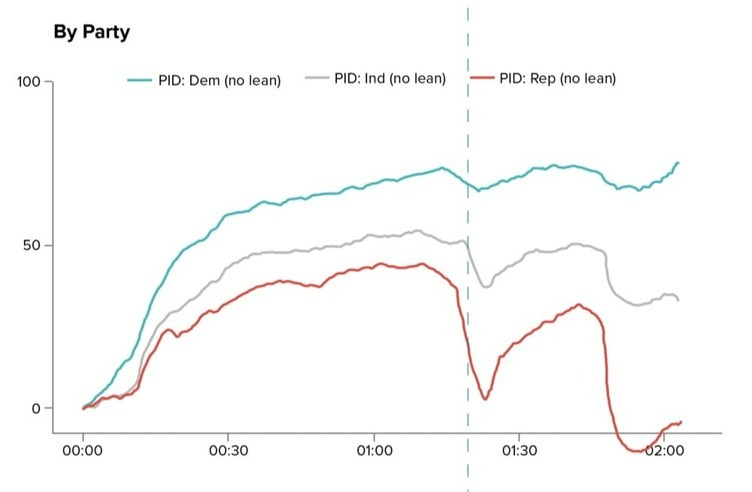

If Bud Light stumbled into controversy, Nike ran toward it. It deliberately stepped into the heat of the culture wars by making Colin Kaepernick the face of its 30th-anniversary Just Do It campaign, titled “Believe in something. Even if it means sacrificing everything.” Kaepernick had been a Nike athlete for years but lost his NFL contract over his political activism. The campaign was more than an endorsement – it was a bold declaration that Nike stood with him, and more fundamentally, that the brand stood for something.

Nike faced a strategic challenge not unlike Bud Light’s: how to maintain brand relevance and align its value proposition with the values of its next generation of consumers. For Nike, that meant connecting with younger, more diverse, and urban audiences. Analysts had begun warning that Nike risked drifting into “dad brand” territory, losing emotional resonance with younger demographics.

The strategy worked. Although Nike initially faced a sharp drop in sentiment, favorability, and share price, the company held its ground. Consumers responded with their wallets – sales rose 30 percent year over year. The campaign generated unprecedented attention, delivering an estimated $163 million in earned media. Most importantly, it rekindled affection for the brand and deepened loyalty among its core consumers, precisely because Nike had taken a stand. As marketing expert Lucas Bean noted, “You’re not boycotting Nike. They fired you as a customer.”

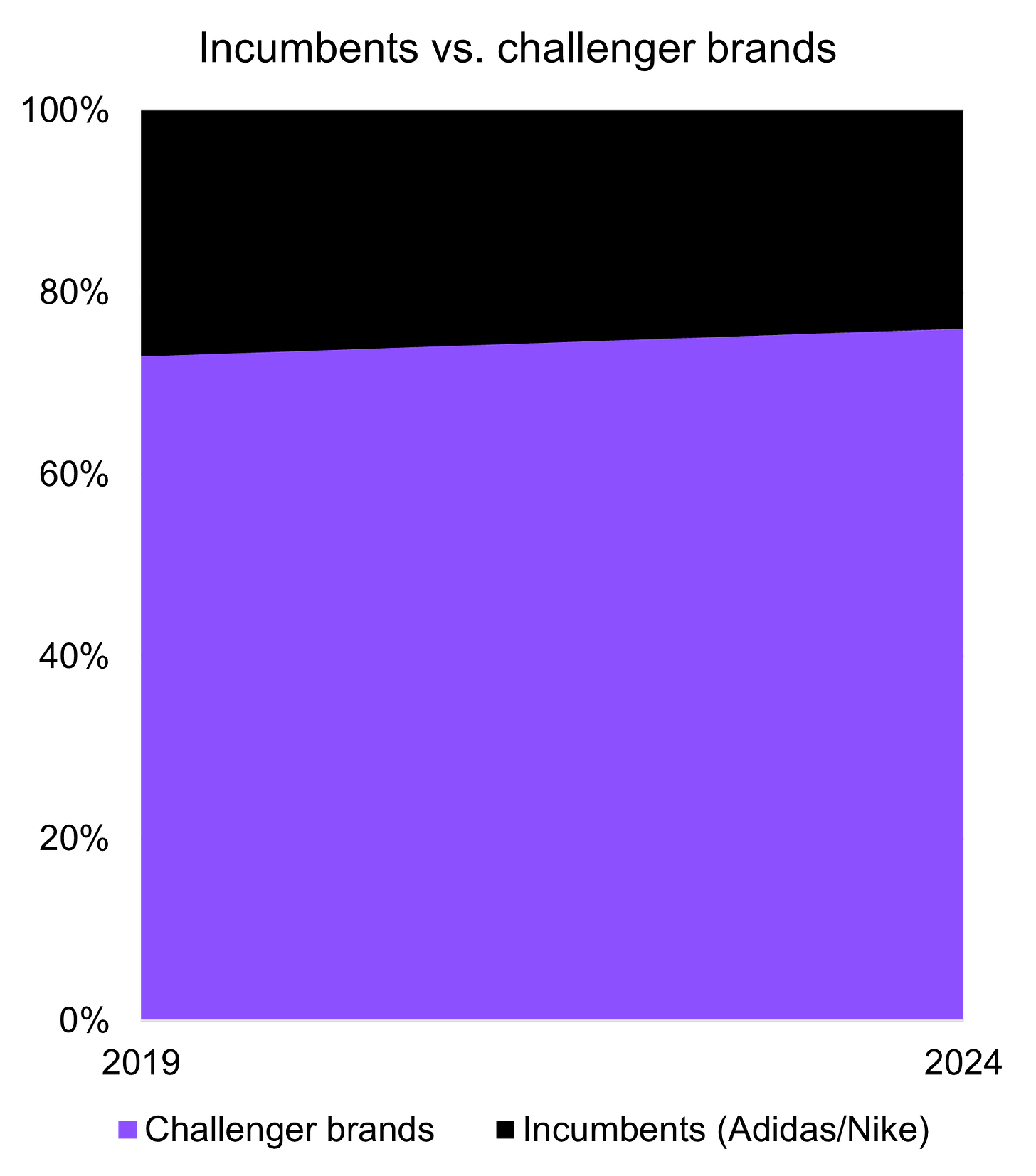

Why the boldness? Nike was following the logic of many high-equity brands: choosing to protect long-term brand value over short-term volume. Luxury labels routinely sacrifice lower-priced opportunities to preserve exclusivity; Nike applied the same principle to cultural relevance. Nike’s later struggles under CEO John Donahoe – when performance marketing replaced cultural storytelling – proved the approach’s necessity: According to McKinsey, since 2019 incumbent brands in the sports apparel market created $10-15b topline value, while the rest of the market created $70-80b. For Nike specifically, critics described the period as “an epic saga of value destruction.”

Under new CEO Elliott Hill, Nike is doubling down on storytelling-driven brand campaigns, launching “Why Do It” – a refresh of its iconic ‘Just Do It’ mantra aimed at reconnecting with younger athletes by emphasizing purpose over product. The shift signals Nike’s return to the strategy that made Kaepernick successful: values-driven brand building that deepens emotional connection.

Nike’s success where Bud Light stumbled comes down to alignment. Its stance resonated with both its existing and target consumers, reinforcing rather than fragmenting its base. And while sports apparel is not immune to substitution, brand equity and perceived authenticity carry real weight – advantages that helped Nike turn cultural controversy into commercial strength.

What Determines Success or Failure

The difference between Nike and Bud Light illustrates fundamental principles about values-based branding:

Customer base cohesion matters decisively. Nike’s customers were ideologically aligned with Kaepernick’s stance and the progressive values the campaign represented. Bud Light’s customers were ideologically fractured – its conservative core was fundamentally opposed to the values signaled by the Mulvaney partnership. A values proposition creates differentiation only when it aligns with customer base cohesion.

Market power provides a buffer – or its absence accelerates collapse. Nike had strong brand equity built on performance, innovation, and cultural relevance. Even customers who opposed Kaepernick faced switching costs (product quality, brand association). Bud Light competed in a highly substitutable category where taste differences are minimal and switching costs are near zero. Without market power to buffer short-term backlash, the brand collapsed rapidly.

Authenticity requires consistency over time. Nike’s support for Kaepernick was credible because it aligned with decades of brand positioning around athletic excellence, social justice (dating back to campaigns with athletes like Muhammad Ali), and cultural leadership. Bud Light’s outreach to progressive audiences contradicted its historical positioning and existing customer values, making the move feel opportunistic rather than authentic.

Values propositions constrain addressable markets. By taking a clear progressive stance, Nike accepted that it would lose some conservative customers – but bet that deepening loyalty among its core growth audience was worth more. Bud Light tried to straddle the divide, alienating both sides. In a polarized market, attempting neutrality or appealing to incompatible constituencies often produces the worst outcome.

Implications for Leaders

For brands navigating values-based positioning, several diagnostic questions emerge:

How ideologically cohesive is our customer base? If your customers span the political spectrum, values-based positioning is high-risk. If they’re ideologically concentrated, it can deepen loyalty.

What is our product’s substitutability? In categories with minimal switching costs (beer, CPG), values misalignment triggers rapid defection. In categories with strong differentiation or switching costs (athletic apparel, technology), you have more room to absorb backlash.

Does this stance align with our brand history? Values positioning that contradicts decades of brand positioning will feel inauthentic. Authenticity requires consistency.

Are we willing to accept a smaller addressable market? Values propositions trade breadth for depth. You may lose customers, but deepen loyalty among those who remain.

Do we have the conviction to hold our ground? Wavering after backlash – as Bud Light did – produces the worst outcome. If you take a stand, commit to it.

The Path Forward

These two cases took place seven and two years ago, respectively. Since then, political polarization has only deepened – intensifying both the risks and the opportunities for brands that engage in values-based messaging. Increasingly, companies across the political spectrum are defining themselves through explicit value positions, whether on social justice, sustainability, or patriotism.

Yet what is often overlooked is that these decisions are rarely ideological in nature – they are commercial. Both Bud Light and Nike faced the same underlying challenge: how to maintain relevance in a changing market. For brands whose traditional consumer bases are aging or fragmenting, values alignment becomes a vehicle for renewal – a way to reach new audiences, signal modernity, and create emotional differentiation in categories where functional differences have narrowed.

The real challenge emerges when a brand’s stated values clash with those of its existing customers, or when it signals a shift that alienates one group while failing to gain traction with another. As Nike’s experience shows, avoiding conflict altogether is not necessarily the safer option. Brands that remain neutral risk losing cultural resonance and emotional connection with the consumers who will drive their future growth. Yet, as Bud Light demonstrates, misjudging audience alignment – or overestimating how transferable brand equity can be across ideological divides – can rapidly destroy value.

In short, values-based branding is not about moral posturing; it is a strategic response to commercial necessity – one that will only become more important in the future. The test for marketers is not whether to engage with values, but how to do so in a way that authentically reinforces brand purpose, resonates with target consumers, and strengthens long-term equity.